Articles

August 2018

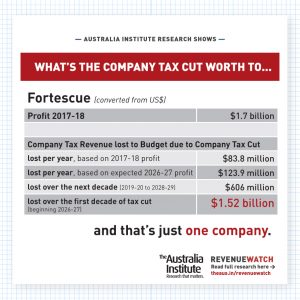

Fortescue – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Fortescue’s annual report, the company tax cut would be a $1.523 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million (converted from US$) Profit 2017-18 1,705.7 Company tax 2017-18 502.8 Benefit from company tax

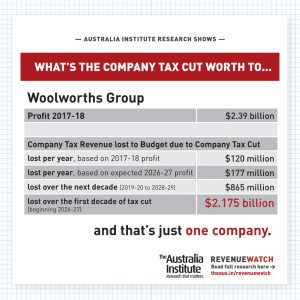

Woolworths Group – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Woolworths Group’s annual report, the company tax cut would be a $2.175 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,394 Company tax 2017-18 718 Benefit from company tax cut based

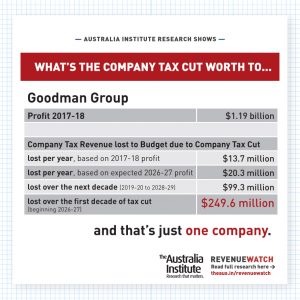

Goodman Group – reported full year results on 17 August 2018

New analysis by The Australia Institute shows that based on Goodman Group’s annual report, the company tax cut would be a $249.6 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,185.2 Company tax 2017-18 82.4 Benefit from company tax cut based

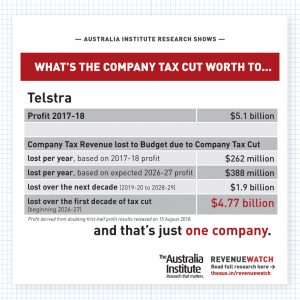

Telstra – reported full year results on 16 August 2018

New analysis by The Australia Institute shows that based on Telstra’s annual report, the company tax cut would be a $4.765 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 5,102 Company tax 2017-18 1,573 Benefit from company tax cut based on

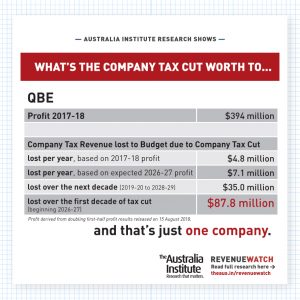

QBE – reported half year results on 15 August 2018

New analysis by The Australia Institute shows that based on QBE’s annual report, the company tax cut would be a $87.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 394.0 Company tax 2017-18 29.0 Benefit from company tax cut based on

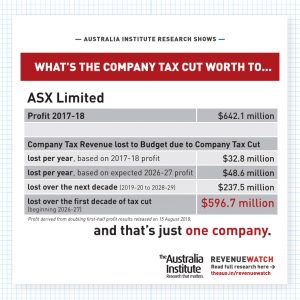

ASX Limited – reported full year results on 16 August 2018

New analysis by The Australia Institute shows that based on ASX Limited’s annual report, the company tax cut would be a $596.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 642.1 Company tax 2017-18 197.0 Benefit from company tax cut based

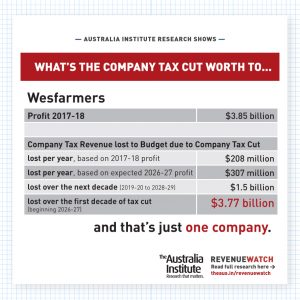

Wesfarmers – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on Wesfarmers’s annual report, the company tax cut would be a $3.77 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 3,850 Company tax 2017-18 1,246 Benefit from company tax cut based on

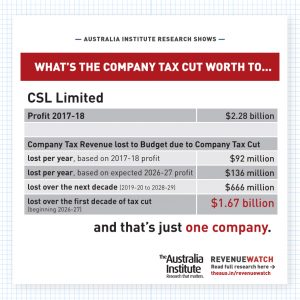

CSL Limited – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on CSL Limited’s annual report, the company tax cut would be a $1.67 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,281 Company tax 2017-18 552 Benefit from company tax cut based

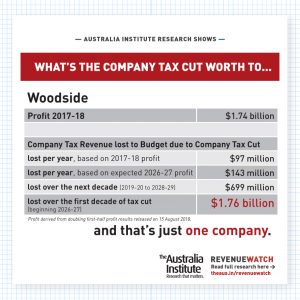

Woodside – reported half year results on 15 August 2018

New analysis by The Australia Institute shows that based on Woodside’s annual report, the company tax cut would be a $1.76 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 (Twice half year result) 1,740 Company tax 2017-18 (Twice half year result)

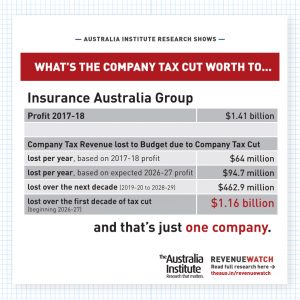

Insurance Australia Group Limited – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on Insurance Australia Group Limited’s annual report, the company tax cut would be a $1.2 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,410.0 Company tax 2017-18 384.0 Benefit from company tax

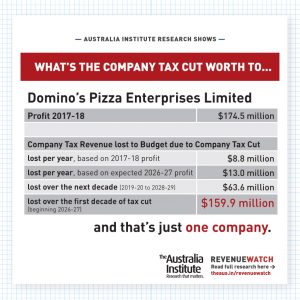

Domino’s Pizza Enterprises Limited – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Domino’s Pizza Enterprises Limited’s annual report, the company tax cut would be a $159.9 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 174.5 Company tax 2017-18 52.8 Benefit from company tax

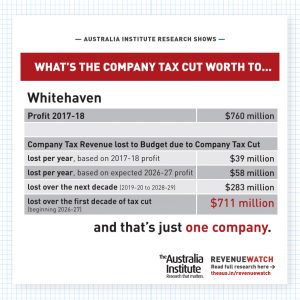

Whitehaven – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Whitehaven’s annual report, the company tax cut would be a $711 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 760 Company tax 2017-18 235 Benefit from company tax cut based on

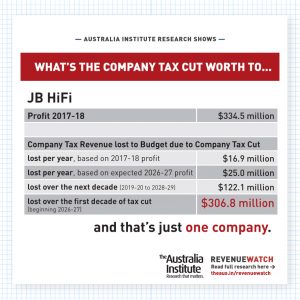

JB Hifi – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on JB Hifi’s annual report, the company tax cut would be a $306.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 334.5 Company tax 2017-18 101.3 Benefit from company tax cut based

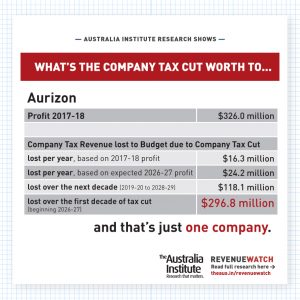

Aurizon – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Aurizon’s annual report, the company tax cut would be a $296.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 326.0 Company tax 2017-18 98.0 Benefit from company tax cut based on

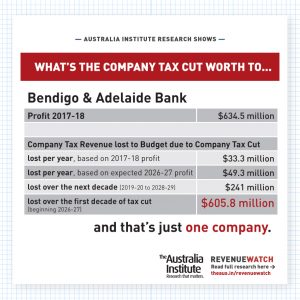

Bendigo and Adelaide Bank – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Bendigo and Adelaide Bank’s annual report, the company tax cut would be a $605.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 634.5 Company tax 2017-18 200 Benefit from company tax

To Federal ICAC or not to Federal ICAC?

Richard Denniss and Senator Kristina Keneally catch up to discuss whether Australia needs a Federal ICAC on The Lucky Country podcast. Arguments for a national corruption watchdog have been percolating in the Australian political landscape for the last few years. Our polling shows that 85% of Australians believe there is corruption in federal politics at a time when

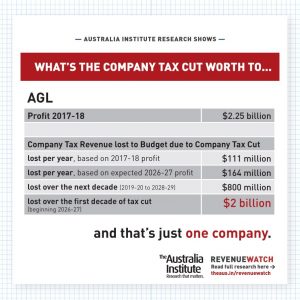

AGL – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on AGL’s annual report, the company tax cut would be a $2.011 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,251 Company tax 2017-18 664 Benefit from company tax cut based on

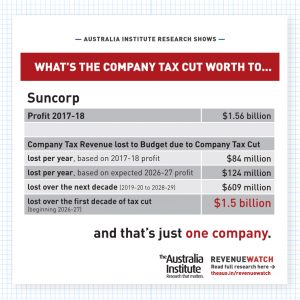

Suncorp – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on Suncorp’s annual report, the company tax cut would be a $1.53 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,564 Company tax 2017-18 505 Benefit from company tax cut based on

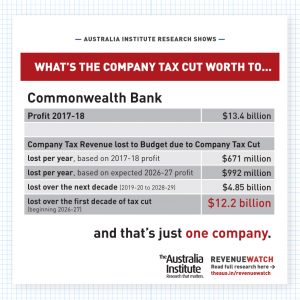

Commonwealth Bank – reported full year results on 8 August 2018

New analysis by The Australia Institute shows that based on Commonwealth Bank’s annual report, the company tax cut would be a $12.195 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Commonwealth Bank $ million Profit 2017-18 13,420 Company tax 2017-18 4,026 Benefit from company tax

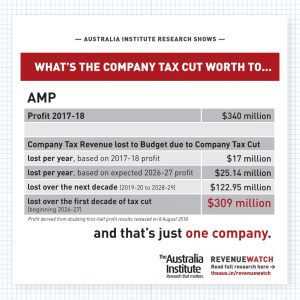

AMP – reported half year results on 8 August 2018

New analysis by The Australia Institute shows that based on AMP’s annual report, the company tax cut would be a $308.95 million gift over the first decade of the cut to just this one company. Return to Revenue Watch AMP $ million Profit 2017-18 340 Company tax 2017-18 102 Benefit from company tax cut based

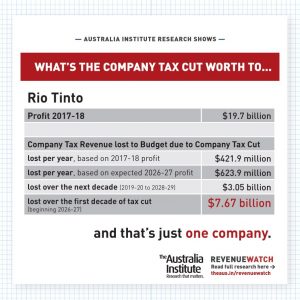

Rio Tinto – reported half year results on 1 August 2018

New analysis by The Australia Institute shows that based on Rio Tinto’s half year report, the company tax cut would be a $7.67 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Rio Tinto $ million Worldwide Income 2017-18 54,844 Profit 2017-18 19,699 Company tax 2017-18

Introducing Revenue Watch

This August, The Australia Institute will be launching our latest initiative: Revenue Watch.

July 2018

Possibly Surprising Insights on the Future of Work

Trade unionists are gathering this week at the ACTU’s triennial Congress in Brisbane. Jim Stanford, Director of the Centre for Future Work, participated in a panel on the Future of Work (an apt title!) at the Congress.

Deconstructing the case for coal

There have been some exaggerated claims about future prospects for coal fired power plants lately — Australia Institute research shows these claims are based on misunderstandings, so lets get clear about coal. Commentators and politicians have recently called for renewed investment in coal-fired power generation, including calls for the government to build a new power station in the

Centre for Future Work at #ACTUCongress18

Trade unionists from across Australia are gathering in Brisbane this week for the 2018 Congress of the Australian Council of Trade Unions. And the Centre for Future Work will be there!

Taxes or Wages: What’s the best way to address inequality?

Richard Denniss, Waleed Aly and Scott Stephens ask the question: is taxation overvalued as a way of addressing inequality? Full interview on The Minefield. Australians are some of the richest people in the world, living at the richest point in world history — but we feel poorer than ever, even after 27 years of economic growth. So how

In defence of the role think-tanks play in public debate

You may have read Miranda Devine’s recent Daily Telegraph piece, criticising The Australia Institute’s research and contribution to the company tax debate. Ben Oquist, Executive Director of The Australia Institute responded in a follow-up piece published in the Daily Telegraph on July 6 which we have reproduced below. Above: Executive Director of The Australia Institute, Ben

June 2018

The whole of the government’s income tax plan has passed the parliament. So, what does that mean?

The government says their income tax cuts create a fair tax plan that rewards ‘aspiration’ and fights bracket creep. The opposition is telling people that it’s a tax cut for the rich. So what will this income tax cut actually do? The overall impact: First, let’s look at who wins from this tax plan. Overall the

Cutting through the Company Tax Cuts Guff

Below you will find all research papers on company tax cuts produced by The Australia Institute to date [updated 25.06.18] The big four banks get an extra $7.4 billion dollars: Australia’s big four banks are some of the most profitable banks in the world and are the big winners here, getting an extra $7.4 billion dollars in the first 10

Super-Powering Past Coal: Renewables Cheaper than Coal-as-Usual

What does the new long-term energy forecast from Bloomberg New Energy mean for Australia? Dan Cass take a look. The new long-term energy forecast by Bloomberg New Energy roasts all those gloomy predictions made by former deputy PM Barnaby Joyce. The headline says it all, ‘Renewables can make Australia a cheap energy superpower again’. BNEF’s detailed forecasts for Australia

General Enquiries

Emily Bird Office Manager

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Advisor

glenn.connley@australiainstitute.org.au